About Us

AV Ventures is ACDI/VOCA’s for-profit subsidiary. We provide innovative, catalytic financing to small and medium enterprises (SMEs) with strong potential for growth and impact in Africa, Central Asia, and Latin America. Such investments contribute to more competitive, resilient, and inclusive market systems and provide better economic opportunities for marginalized communities.

By building off the strong foundations and deep networks developed by ACDI/VOCA’s programming, we strive to create systemic change through our investments. As a result, we can go beyond traditional impact investing to create returns and impact where traditional investors stop short — at earlier, seed and growth stages in lower income countries and underfunded sectors.

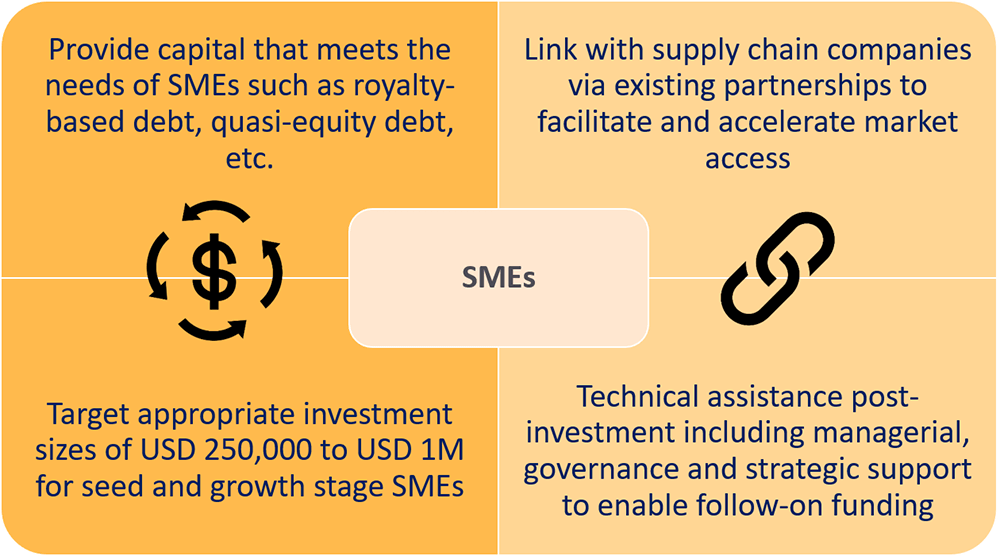

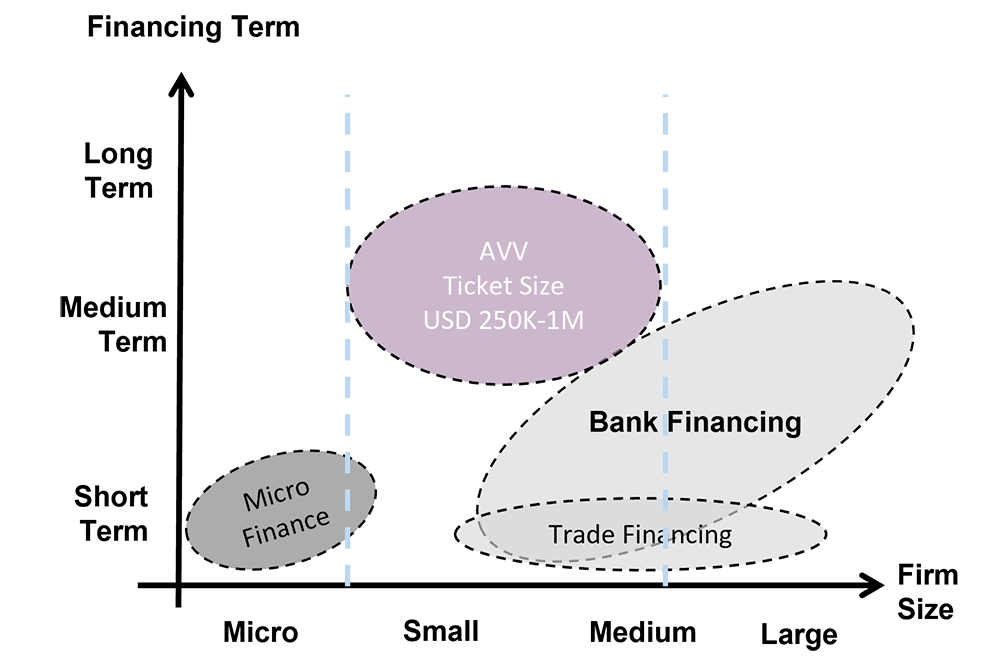

Financial Innovation

At AV Ventures, financial innovation is part of our DNA. ACDI/VOCA’s experience supporting SMEs for decades made it clear that the “missing middle” was about more than access – it was also about matching financial products with the needs of growth-oriented firms.

- From AVV’s very first investment, we have offered innovative products such as revenue-based loans to support these firms with flexible, risk-sharing products tailor made to their needs and environments.

- We have also targeted a range of SMEs often left out of the impact investing movement: those seeking to raise between $250,000 and $1 million.

- Finally, recognizing the multiple barriers such firms face if they are to grow, we link our investments not only to technical assistance but to critical market linkages offered by ACDI/VOCA’s global network.

In these ways, we hope to push the innovation frontier globally and share our results and learning with the broader impact investing community.

Our investment thesis centers on bringing financial innovation to the challenge of investing in systemic change. This means going beyond reaching sales, production, or employment targets in a particular value chain, to looking at how we can fundamentally change the structure or dynamics within a broader system. This is how we contribute to ACDI/VOCA’s mission of promoting markets in developing countries in which business owners, smallholder farmers, and communities are empowered to succeed.

Team

AV Ventures’ headquarters is in Washington, DC. The global team supports AVV’s three investment vehicles, each of which is led by a local investment manager and supporting local staff. The global team also supports AVV’s partnership with Pomona Impact in Central America.

AV Ventures – Washington DC

Geoffrey Chalmers

Managing Director

View Bio

20+ years’ experience in development partnerships, catalyzing investment in emerging and frontier markets, and enterprise development.

Ovidiu Bujorean

Technical Director, Partnerships & Investments

View Bio

20+ years’ experience as an investor, serial entrepreneur, and architect of global, regional, and national entrepreneurship initiatives in ICT, green, agriculture, and healthcare. Deeply passionate about impact investing, blended and climate finance through creative public-private partnerships, and innovative data-driven approaches to societal challenges.

Valentina Echeverry

Director, Partnerships and Investments

View Bio

15 years’ experience impact investing, international development and investment management in emerging markets, including building up and managing investment and co-investment portfolios of high impact SMEs across Latin America.

AV Ventures – Ghana

Zubeiru Salifu

Senior Investment Manager

View Bio

- 15+ years’ experience working in SME finance in West Africa;

- 10+ years at the Private Equity firm Mustard Capital

- Lead deal management, deal sourcing, and deal origination for AVVG.

Winfred Kumi

Senior Investment Associate

View Bio

5+ years’ experience working in SME finance and investment banking in Ghana.

Sally Amoasah

Investment Associate

View Bio

3+ years’ experience working to provide professional audit and assurance services for a wide range of SMEs in Ghana.

AV Frontiers (Central Asia)

Taalaibek Djoumataev

Co-founder & Managing Partner

View Bio

CEO of Frontiers. Extensive banking experience as former CEO and Chairman of the Managing Board of Bank of Asia, one of Kyrgyzstan’s private commercial banks. Served as a Member of the Supervisory Board of the Union of Commercial Banks of the Kyrgyz Republic. Critical role in the structural and regulatory changes made to the Kyrgyz financial system during the country’s shift to a market-based economy.

Farkhad Abdyrakhmanov

Investment Manager

View Bio

10+ years in financial sector in commercial banks and at Frontiers MLC, as portfolio manager for wholesale lending to microfinance institutions. Extensive experience in financing small and medium-sized businesses in the banking sector, starting as a specialist and growing to the position of regional coordinator of the Credit Department

Adilet Aitiev

Senior Investment Associate

View Bio

Adilet has worked for several well-known financial companies and government authorities, including the National Bank of the Kyrgyz Republic, Morgan Stanley and MLC “Frontiers”. He graduated from Central European University with an MA in Economic Policy in the Global Market.

AV Ventures – Kenya

Ronald Musundi

Investment Manager

View Bio

Ronald Musundi is the Investment Manager and Local Representative of AV Ventures LLC in Kenya, a for-profit subsidiary of ACDI/VOCA. He supports AV Ventures’ impact investing activities in Kenya, which include management of the Impact for Northern Kenya Fund, funded by USAID KUZA and targeting the ten northern Frontier Counties of Kenya. Prior to joining AV Ventures, Ronald worked within the impact investing and financial services space for the Cooperative Bank of Kenya, Business Partners International SME fund, GroFin International Fund, and Safaricom Investment Fund. He holds an MBA in Finance from Jomo Kenyatta University of Agriculture and Technology, Bachelor of Commerce (Finance Option), 2nd Upper Class Honors from Kenyatta University and is also a Certified Public Accountant (CPA-K).

Damaris Ochieng

Investment Associate

View Bio

Damaris Ochieng is the Investment Associate with AV Ventures LLC in Kenya. She supports the Impact for Northern Kenya Fund in deal sourcing, due diligence, financial modeling, deal structuring, portfolio management, and client relationships. Prior to AV Ventures, Ms. Ochieng worked as an analyst for Ubora Advisors, LLC and had corporate, commercial, and credit card analyst positions with Ecobank Kenya Ltd. She has a Master of Science in Finance from the University of Nairobi, a bachelor’s in accounting from Kenyatta University, and numerous certifications relating to investment and commercial banking.

Partners

Funds

AV Ventures currently manages $46.8 million in three early-stage impact investing vehicles: AV Ventures Ghana LLC (AVVG), a $3.6 million agribusiness fund; AV Frontiers Central Asia Investment Fund (CAIF), a sector-agnostic fund of $5.2 million; and a $38 million Fund in Kenya.

Portfolio Highlights

AV Ventures’ investee companies across our three investment funds are high-growth, high-impact companies with dynamic, entrepreneurial leadership. AV Ventures’ portfolio partners benefit from innovative, risk-sharing financial products and a growth-enhancing approach to portfolio management driven by our aligned incentives.

Roots to Foods Podcast

Welcome to the RootsToFoods podcast, brought to you by AV Ventures, your gateway to the dynamic world of African agriculture. Join us on this exciting journey as we dive deep into the agricultural sector, exploring innovative financing, investment opportunities, and cutting-edge technologies that are reshaping the landscape of African agriculture. We’re here to empower you with knowledge and inspire you to be a part of the food resilience revolution on the African continent. In addition, the podcast will highlight approaches to challenges and specific strategies to achieve success. We will prominently feature the topics of building complementary teams, scaling ventures, and business building. The RootsToFoods podcast is a rich resource hub and community of entrepreneurs, executives, and investors in the agtech, food systems, and climate adaptation sector in Sub-Saharan Africa.

Listen and subscribe for free on your favorite platform >>> Apple Podcasts, Podbean, Spotify.

Your Host

The RootsToFoods podcast is designed and hosted by Ovidiu Bujorean, Director for Partnerships and Investments with AV Ventures. He is spearheading AV Ventures’ growth in Sub-Saharan Africa and is keen on building impactful educational and financial vehicles that support middle agribusinesses and agriculture-adjacent technologies. Ovidiu designed the GIST Network and positioned the resource to become the State Department’s global flagship entrepreneurship program. The GIST Network included TechConnect, a pioneering entrepreneurship broadcast that featured prominent entrepreneurs from the U.S. and emerging markets. TechConnect hosted speakers such as Jeff Hoffman of Priceline; Nolan Bushnell, the founder of the online gaming industry; and Rich Barton, the founder of Zillow and Glassdoor.

Speakers

Speakers includes Agritech Entrepreneurs and Innovators, Philanthropists and Investors Government Officials, Environmentalists and Climate Experts, Climate-Resilient Farming Advocates, Agricultural Extension Specialists and Agribusiness Entrepreneurs etc.

Upcoming Episodes

| Episode | Episode Name |

|---|---|

| 1 | Innovative Financing on the Panel of the 2023 U.S.-Africa Summit |

| 2 | Revolutionizing African Agriculture through Precision Farming |

| 3 | Scaling up Agtech Ventures Across the African Continent and Beyond |

| 4 | Women-Focused Agritech Innovations |

| 5 | Harnessing Drone Technology for Sustainable Farming |

| 6 | Women’s Leadership in Climate-Smart Agriculture |

| 7 | Vertical Farming: Growing Crops in Limited Spaces |

| 8 | Building a dynamic and complementary entrepreneurial team |

| 9 | Hydroponics: Soilless Farming for Resource-Constrained Environments |

| 10 | Impact investing in agriculture across the African continent |

| 11 | The Power of Collaborative Partnerships for Climate Change Adaptation |

| 12 | Enhancing International Cooperation for Climate Change Adaptation in African Agriculture |

Careers

USAID Kuza’s Impact Fund for Northern Kenya (INK Fund) is seeking short-term technical assistance. To apply, please follow the directions on the job description.

Investment Product Scoping STTA

Maphlix Trust Ghana Limited, a portfolio company of our AVVG fund in Ghana, is seeking the following positions. Please contact them directly to apply or with any leads.

Chief Financial Officer – Maphlix Trust Ghana Limited

Chief Operating Officer – Maphlix Trust Ghana Limited

Quality Control Manager – Maphlix Trust Ghana Limited