In early 2020, the Feed the Future Bangladesh Rice and Diversified Crops Activity began an assessment to understand how the Activity could increase financial access for agricultural small- and medium-sized enterprises (agri-SMEs) in Bangladesh during COVID-19. The assessment originally focused on opportunities for the Activity to increase financial access through agent banks during the pandemic. However, the result was a yearlong assessment and realization of the agent banking model’s ability to increase supply- and demand-side resiliency.

As highlighted in previous blogs here and here, agent banks were incredibly flexible during the pandemic and saw significant growth in rural communities in Bangladesh. Today, we are excited to share the results of the yearlong assessment and highlight a key finding in our last blog of the series.

Access to Credit Is Not the Only Solution to Build Financial Inclusion

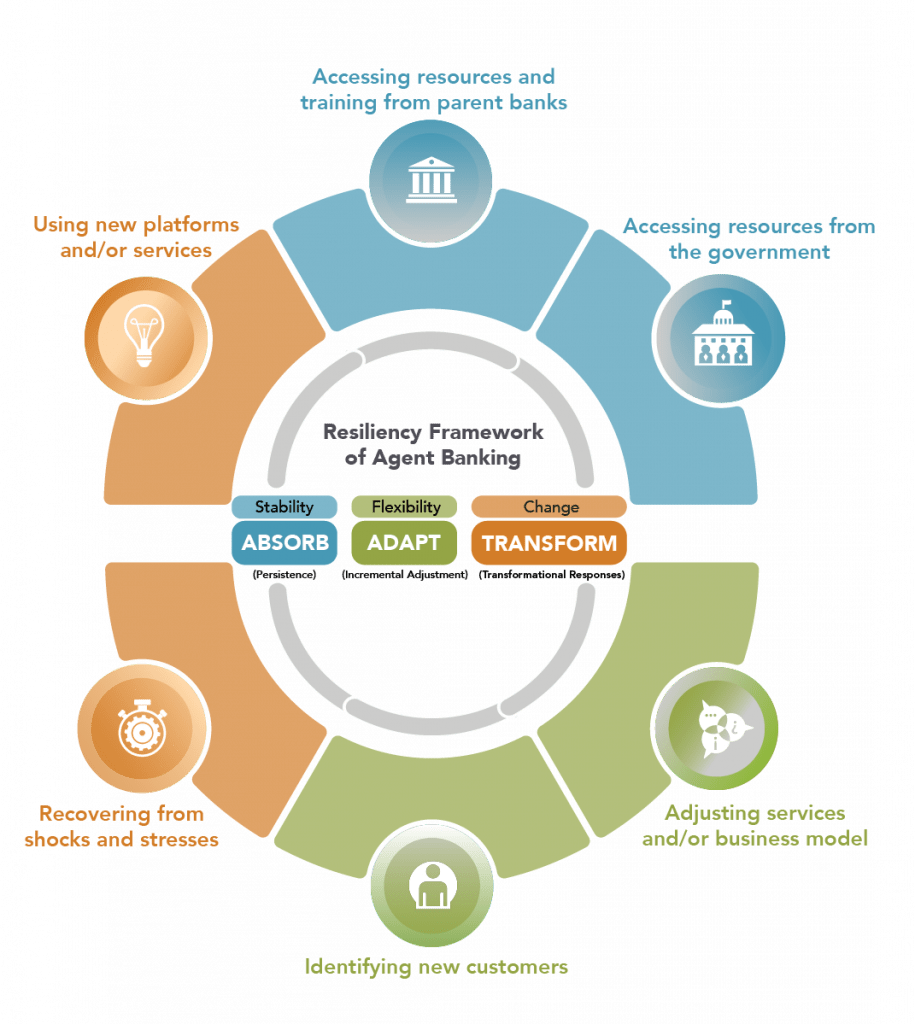

By applying a market systems approach and tailored resiliency framework (see graphic) to our assessment, we were able to understand, diagnose, and identify different aspects of the agent banking model that contributed to financial inclusion. For example, frequently, we measure financial inclusion by the ability of underserved populations to access quality credit. However, the assessment highlighted the importance of not solely relying on access to credit to measure inclusion.

A Shift in Demand

Since 2016, agent banking has been gaining popularity among rural Bangladeshis. During the COVID-19 pandemic, we witnessed a more rapid shift in behavior change. Agri-SMEs that traditionally accessed more informal financing were shifting rapidly to formal services through agent banks due to the reliability provided during uncertain times.

By offering diverse financial services — from cash-in and cash-out to utility payments, bank account openings, savings products, remittances, and fund transfers — agent banks not only served agri-SMEs but also contributed to a larger behavior change in how these SMEs accessed formal financial services. Our assessment found evidence that this occurred because agent banking made financing more accessible and affordable compared to traditional informal financing services, which experienced prolonged lockdowns. Due to this reliability, agri-SMEs showed increased interest in using agent banks to increase their savings and more accessibly pay bills and send remittances. With these affordable services, agri-SMEs began more frequently accessing their agent banks and contributing to a larger behavior change that could lead to market systems changes from both the parent banks and the agri-SMEs in the long term.

A Shift in Supply

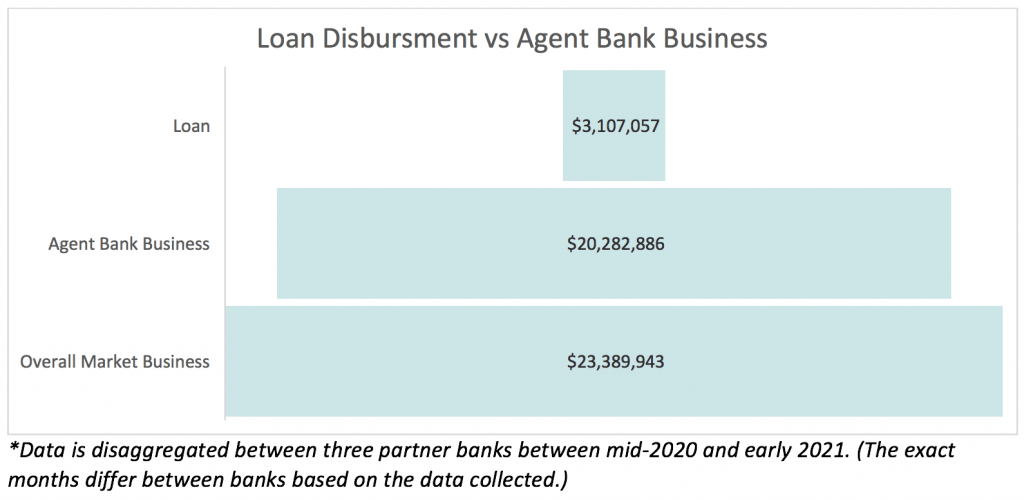

As the demand for more reliable banking services increased during the pandemic, bank leadership observed agent bank deposits increasing. This additional source of revenue strengthened the business case for banks to expand their agent networks and target agri-SMEs. As seen in the figure below, agents played a large role in developing healthy and diverse financial portfolios for the parent banks during a time when many banks experienced significant liquidity pressures. Agent banking business from our three partner banks, Bank Asia, BRAC Bank, and City Bank, contributed 85 percent of their overall profits, continuing to prove not just the sustainability but also the profitability of the agent model.

Lessons Learned

As we continued to build the business case for banks to expand their services into rural agricultural communities and increase their agricultural lending, we learned three main things:

- Agent banks are profitable for banks. They are also a resilient channel that continues to provide necessary financial services to rural customers during shocks.

- Agent banks provide an efficient channel for banks to increase their footprint in rural communities that were previously a barrier to expansion for banks. The proximity of the agents to the end borrower provides an opportunity for greater trust-building, creditability, and breaking of bias against the agriculture sector. This proximity also helped rural clients notice that agent banks were still open when most other outlets had closed.

- Offering a combination of agent baking services, including access to credit, is crucial for the banks to maintain and grow their secure lending portfolios and, thus, ensure sustainability and resilience.

To ensure the financial needs and services of the community are met, development programs need to pursue strategies that focus on long-term sustainability and value creation for both the supply and the demand sides. We hope you can learn from the experience of the Feed the Future Bangladesh Rice and Diversified Crops Activity throughout this blog series, on how support to agent banking models can increase financial resiliency for rural communities.

Access previous blog posts on this topic using the links below:

In Wake of COVID-19, Bangladesh Banks Pivot Toward Community and Digital Solutions

COVID-19 Crisis As a Lens to Understanding Resiliency of Agent Banks in Bangladesh

Comments