The Upper East Region is a less traditional alcove of Ghana where communities are more open to women taking part in commercial activities. Its neighboring Northern Region is more conservative. In January 2020, the Feed the Future Ghana Agricultural Development and Value Chain Enhancement II (ADVANCE II) Project conducted a gender assessment in these culturally distinct regions to explore how women performed as members of village savings and loan associations (VSLAs).

A VSLA is a group of 20 to 35 smallholder farmers who are often unable to access traditional banking and instead meet regularly to contribute small amounts of their earnings to a pooled savings fund, often stored in a lockbox. VSLAs use their combined savings to provide loans to individual members, who pay them back over time with a small amount of interest.

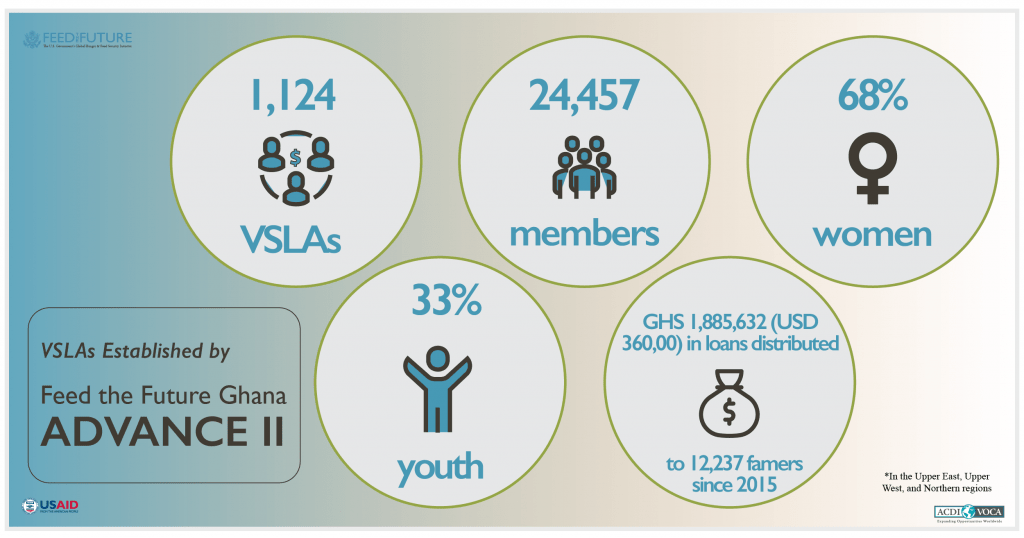

The Feed the Future Ghana ADVANCE II Project, funded by USAID and implemented by ACDI/VOCA, has helped create more than 1,100 VSLAs, of which 68 percent are female members. Creating these groups is one approach to overcoming the financial barriers women face and making the maize, rice, and soybean value chains in Ghana more inclusive as women grow their farming businesses.

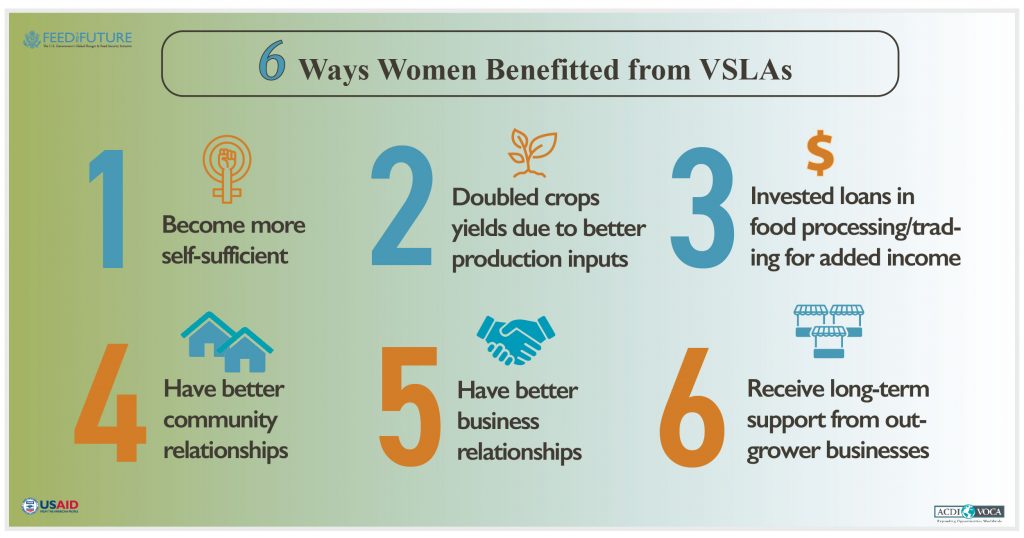

The study found six ways that joining a VSLA benefitted women in the two regions:

1. Women became more self-sufficient

Having some financial independence as VLSA members allowed many women to rely less on their husbands. Some took on shared decision making with their husbands, while others made decisions on their own about how to save and spend their income. When women did make decisions independently, most of them paid for their children’s school fees or healthcare before investing in their farms.

2. Having access to cash and credit allowed women to improve their farming

Members could afford to purchase higher-quality products because agricultural input dealers selling seeds and fertilizers felt comfortable filling their orders on credit. Group members could also pay for timely services, such as plowing, without having to wait until they had enough funds. Timely plowing is critical in this part of Ghana where there is only one annual crop season.

After joining VSLAs, some women began farming on larger plots, using their combined savings to expand production. Many women who used to plant just one staple crop also began producing soybean, okra, and other diversified crops as their plots grew.

3. Women used loans to invest in ways to earn an income during the dry season

The wet or rainy season in Ghana, which runs from April to October, is when farmers grow maize, soy, and rice. These crops do not grow during the dry season, when many farmers struggle to earn an income. In 2013, a survey conducted by the ADVANCE I Project found that women wanted more support with dry season activities. VSLAs made this possible. With access to loans, women could invest in other dry season livelihoods in agriculture, commerce, or trade.

The possibility to earn income all year sparked an entrepreneurial spirit among members, many of whom started dry season activities, such as raising livestock or selling clothing, for the first time. Others expanded their existing dry season work through VSLA loans.

4. Community relationships improved

Relationships within households and among members improved. Having enough income to pay for needs such as school, healthcare, and nutritious meals alleviated a great deal of stress at home.

Members also gained a support network. Closely affiliated groups met often to share what they learned or chatted through the mobile messaging application WhatsApp. Through their networks, members could buy their agriculture inputs together in bulk and divide up the goods to save on costs.

A portion of members’ contributions also went toward a social fund. Social funds can be accessed by individuals with the group’s permission for an interest-free loan or grant. Mostly used for medical emergencies as well as funerals and other ceremonies, the funds acted as social insurance, making costs more manageable over time and preventing households from taking extreme financial risks.

5. Business relationships improved

With more access to cash, women relied less on credit. And when they did, they could be trusted to repay loans on time. Because of their access to cash and reliability, local businesses and financial institutions felt motivated to take on more women as customers. This resulted in women having new opportunities to buy better and more supplies as well as receive more services than before to improve their farming practices.

6. Outgrower businesses are investing in the sustainability of VSLAs and continued work with women

Outgrower businesses, mainly commercial farmers and aggregators, see the value of supporting VSLAs. VSLAs help them expand their own businesses and respond to demand. These outgrower businesses, which have been forming networks since 2018, support smallholder farmers by providing them with training, access to markets, and inputs and farming services on credit. Many reported that they found female VSLAs members to be reliable, entrepreneurial, and successful at farming. Because of this, they have a special interest in supporting the creation of more VSLAs.

Ensuring that VSLA groups operate effectively going forward will allow women to continue improving their economic security. To learn more about our findings and recommendations for how to continue supporting VSLAs, we encourage you to read the report, “Gender Assessment of Women Participation in Village Savings and Loans Associations (VSLAs): A Study on Rural Women in VSLAs in Ghana’s Northern and Upper East Regions” (February 2020).

Learn more about the Feed the Future Ghana ADVANCE II Project here.

Learn more about our work in Ghana here.