Kounti Bamanan is a rice producer organization in Djénné, in Mali’s Mopti Region. For the last five years, the group’s ability to access funding for agricultural production has become increasingly difficult, largely due to insecurity in the region. The National Bank for Agricultural Development (BNDA), which focuses on financing agricultural activities in Mali, has reduced its presence and credit facilities because of this growing instability and the growing default rate among farmers who are unable to produce under the existing conditions. As the risks increased, trust between producer organizations and the BNDA as well as other financial institutions has deteriorated. The result is a serious sector-wide slowdown in agricultural production in the Mopti Region.

The USAID Cereal Value Chain (CVC) Project, implemented by ACDI/VOCA, is well-known for its capacity to train producer organizations in the best agronomic practices and the adoption of innovative production technologies. The project has also focused on strengthening the capacity of producer organizations to secure lending to improve their agriculture productivity. However, the existing lending environment in the Mopti Region is a challenge for the USAID CVC Project and the groups it supports.

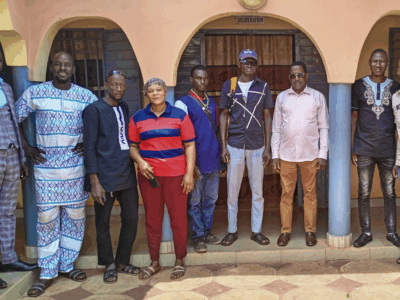

Field agents from the USAID CVC Project and financial intermediaries have trained these groups in how to manage businesses, develop business plans, and increase awareness among banks in the region of the USAID CVC Project’s efforts to build their capacity to both access and repay loans. These efforts have recently resulted in two producer organizations — Kounti Bamanan of Djenné and Sagognini of Korientzé — securing commercial loans.

“This is a dream, and I don’t want to wake up. But I say thanks to [the USAID CVC Project] that just saved us from a nightmare.”

Sékou Tangar, president of the Kounti Bamanan

This unlikely financing was unique within the Mopti Region, as well as other areas where the USAID CVC Project operates, because the International Bank of Mali issue the loan. Most agricultural lending in these regions happens through BNDA. The International Bank of Mali is a commercial bank with limited experience in agricultural lending.

However, the bank agreed to finance the two producer organizations less than two weeks after negotiations took place with a financial intermediary trained by the USAID CVC Project. The financial intermediary was able to convince the bank with solid documentation to release US$19,033 in financing to be divided by the two producer organizations: the Djenné group and its 28 members, including eight women; and the Korientzé group and its 70 member, including five women.

Through the USAID CVC Project and its financial intermediaries, producer organizations are finding it possible to mobilize agricultural financing from non-agricultural banks.

Learn more about the USAID Cereal Value Chain Project.

Learn more about our work in Mali.