Where to intervene is one of the most critical challenges a project will face. ACDI/VOCA’s Systems Diagnostic helps make sense of how systems function and what are the most influential factors for driving broad-based impact. The Diagnostic provides a methodology for selecting high-leverage factors that are the backbone for our market and food systems change strategies. While most of ACDI/VOCA’s work focuses on market and food systems, the Diagnostic can be used to understand any type of complex system. It goes beyond just looking at individual actors’ behaviors in a system to looking at the system as a whole. It explores how factors —from power dynamics to networks— are driving the overall system performance. This broader view helps us see beyond immediate constraints to consider more impactful and sustainable systems change outcomes.

What It Is

- A step-by-step process for making sense of complex systems with the aim of developing a systems change strategy

- Customizable guidance for working with local systems actors to identify high potential areas for impact that inform a clear vision for systems change

- While ACDI/VOCA typically uses this tool during project inception, projects can apply it at any point in the program cycle, such as part of annual or mid-term reviews or after a significant shock

- ACDI/VOCA has applied the Systems Diagnostic in Colombia, Ghana, Honduras, Serbia, and Tajikistan. Examples are provided throughout.

Methodology

The Diagnostic starts by prioritizing the most relevant determinants of change within a system (e.g., policies, practices, resource flows, relationships, power dynamics, and mental models). Relying on formative systems analyses (e.g., value chain/end market analyses; political economy analysis; gender, youth, and social inclusion analyses, etc.) as well as participatory systems analysis methods, such as whole-system-in-the-room, the Diagnostic identifies a short-list of factors that are then prioritized by a group of system analysts. The Diagnostic then applies structural analysis (an approach to modeling the relationships between influential factors in a system) to understand causality between systems factors. Final systems change strategies are co-created with key stakeholders to ensure feasibility and buy-in to the vision for change.

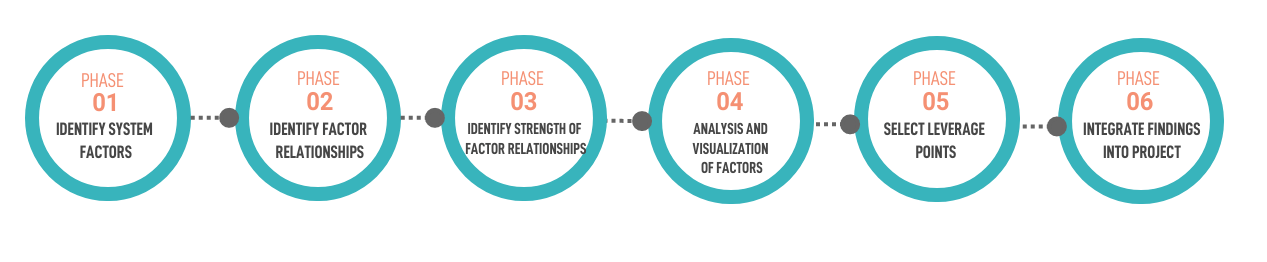

The Systems Diagnostic, using the structural analysis methodological framework, proceeds in six phases:

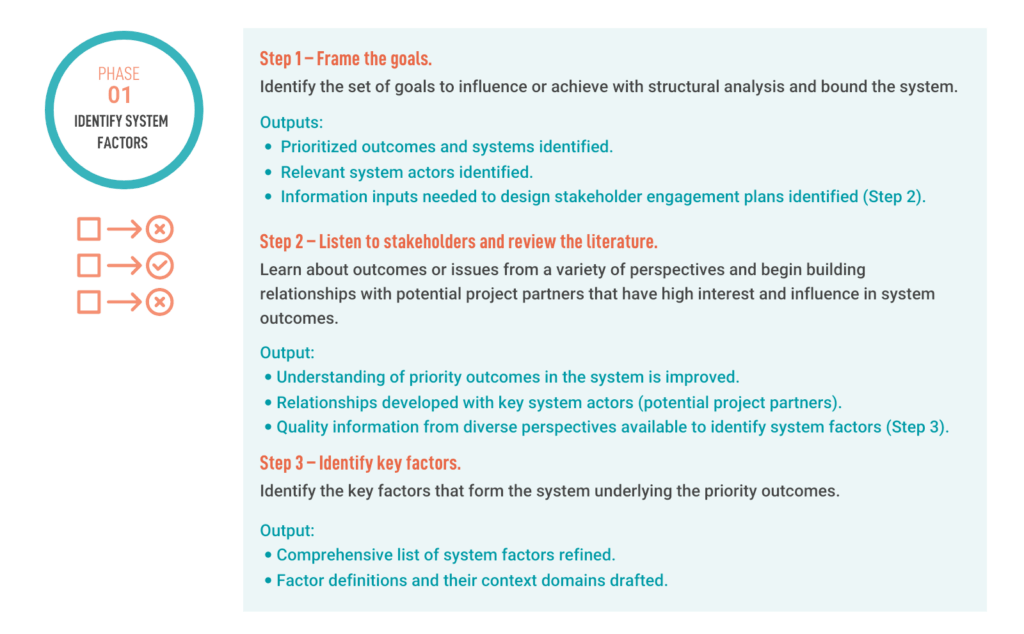

Each phase is comprised of one or more steps, for a total of 10 steps. An overview of all phases and steps is provided below and explained in detail in the Diagnostic. While this framework aims to succinctly present the core requirements and considerations for each step of the analysis, in practice the complexity and implementation plan of each step will vary depending on the scope, timeline, and needs of each unique project.

Use Cases

The Diagnostic includes many examples from ACDI/VOCA’s projects. The following use cases represent a selection from the Diagnostic:

Use Case for Step 1: Identifying Objectives and Gathering Diverse Perspectives in Colombia

The Youth Resilience Activity (YRA) in Colombia, funded by USAID and implemented by ACDI/VOCA, prioritized the outcome of improved youth psychosocial and life skills. When deciding what parts of the system to include, YRA considered multiple social and environmental sub-systems impacting youth’s positive development: (1) health; (2) mental health and case management service systems (CSO/NGO, public, and private providers); (3) infrastructure, including physical spaces for recreation and extracurricular activities (public and private sector); (4) policy and regulatory systems (youth councilors, public policy, etc.); (5) norms and behaviors (shifting mental models, communications and social behavior change initiatives, etc.); (6) familial and peer support networks; (7) education; and (8) workforce development and labor market systems. To inform its initial understanding of the issues affecting youth resilience, YRA conducted several complementary studies during project inception: risk assessments, economic analysis, network analysis, and gender and social inclusion analysis.

Use Case for Step 2: Whole-System-in-the-Room (WSR) Workshops in Ghana and Tajikistan

The Feed the Future Ghana Market Systems and Resilience Activity and the Market Driven Rural Development Activity, both funded by USAID and implemented by ACDI/VOCA, engaged with a diverse set of system stakeholders through a series of locations (Ghana) or sector-specific (Tajikistan) systems workshops. Workshop participants were strategically selected to represent the whole set of system actors. Each workshop held breakout sessions comprised of six discussion groups with each group assigned to discuss a key determinant of system functioning: (1) behaviors and practices, (2) relationships and networks, (3) resource flows, (4) diversity of elements, (5) standards and policies, and (6) power dynamics. (See Step 3 for details on each determinant.) Facilitators synthesized systems determinants worksheets and discussion notes from multiple workshops into a comprehensive set of system factors for their respective system determinant.

Use Case for Step 3: Factor Coding Method in Colombia, Ghana, Honduras, Serbia, and Tajikistan

ACDI/VOCA-led projects in Colombia, Ghana, Honduras, Serbia, and Tajikistan identified the list of key factors using an open coding method wherein analysts (a) reviewed stakeholder WSR and systems worksheets, reports, and narratives; (b) created a list of factors and definitions; (c) compared, merged, or selected factors as new perspectives were made available; (d) identified the context domain for selected factors; and (e) re-analyzed and re-labeled factors, as necessary, following internal review with a wider range of technical experts.

Use Case for Step 10: Adapting Programming to Focus on Leverage Factors in Serbia

For the Big Small Businesses Project in Serbia, funded by USAID and implemented by ACDI/VOCA, workforce availability emerged as a leverage factor for the growth and development of the equipment and machinery sector due to its high influence and low dependence on other system factors. Equipped with this improved understanding of system dynamics, the project focused work plan activities directly on workforce availability, in particular the availability of engineers and technical workers and the factors influencing availability, such as the lack of feedback loops between the education system and private sector leading to skills mismatches. Specifically, these activities include the development of a rapid prototype development hub in collaboration with the Academy of Technical and Vocational Studies and the Center for Business and Innovation Support, which will provide a needed service to SMEs in the equipment and machinery sector, but also give students real world experience.