By Bob Fries, Chief Technical Officer of ACDI/VOCA

This summer, I am wrapping up a 36-year career working with international development efforts designed to increase incomes and economic opportunities for farmers, rural families, and small business owners in Asia, Africa, and Latin America. Cleaning my office in preparation for my retirement, I opened a time capsule and found an artifact that set the stage of an amazing transformation, one launched by U.S. taxpayers, and one reflective of the long-term power of foreign assistance.

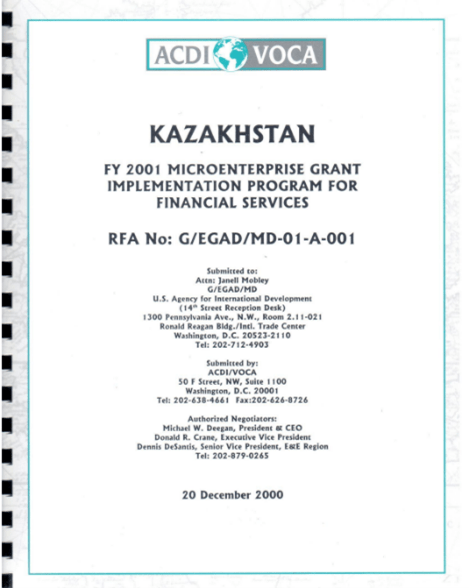

The time capsule, a cabinet in my office, contained proposals I had worked on over the years. Among them was a thin grant application from December 2000, for KazMicroFinance LLC (KMF) , a tiny not-for-profit microfinance fund in Kazakhstan. This one caught my eye because I would soon be heading to Central Asia and meeting with KMF. Having grown dramatically over the last quarter century, they are expecting their banking license this summer. I thought this historic relic would amuse them.

When I shared the proposal the following week with Shalkar Zhusupov, KMF’s CEO, he was visibly moved. He held in his hands both a concrete reminder of his career’s early years and documentation of KMF’s unimagined growth and impact. This document contained

- The ask. $1.6 million to fund technical assistance and defray operating costs for a third branch (their first urban one) in Almaty

- The vision. To grow from two successful rural branches to a national organization with the systems and capacity to provide loans to a continually growing clientele of microentrepreneurs

- The commitment. A letter signed by Shalkar committing KMF to leveraging U.S. Agency for International Development resources with commercial sources of funds, so that the grant would propel them to be the leading small-scale lender in Kazakhstan

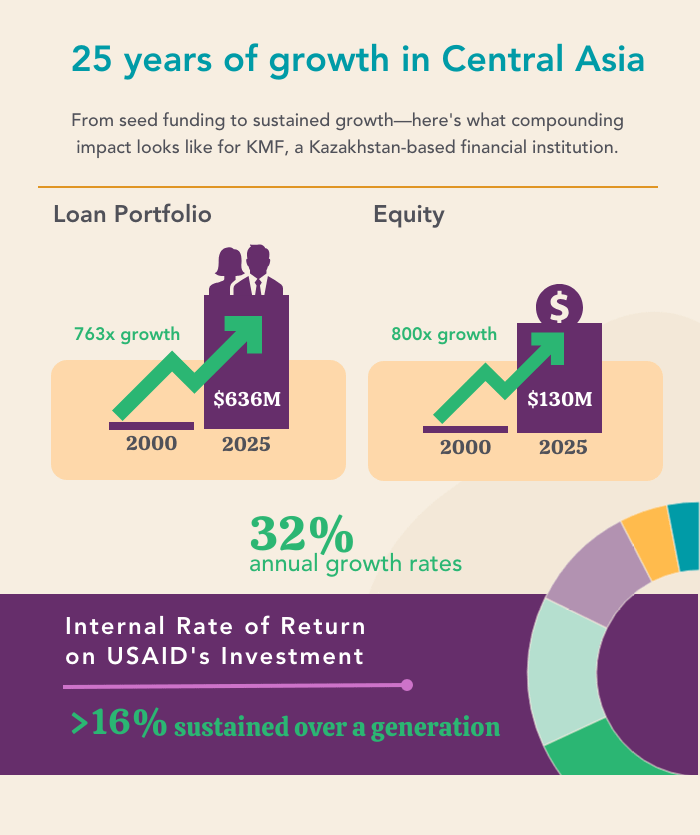

- The targets. By 2004, KMF hoped to quadruple its outreach from 3,900 borrowers to 14,500 and from $750,000 in loans to $3.2 million. KMF also hoped to increase its equity by five times to $850,000.

While we did not recall the proposal’s details, clearly KMF had achieved its vision, lived up to its commitment, and shattered its targets. By the numbers, this project produced an incredible return on investment. In KMF’s first seven years, USAID invested $6.5 million in technical assistance, loan capital, and start-up costs. Last year alone, KMF disbursed $680 million in loans averaging $2,100 to more than 275,000 small businesses and farm families.

But numbers alone do not capture the full story. As we flipped through the proposal in the KMF office, we recalled 25 years of people, experiences, and impact:

- Early volunteers who came with fresh skills and ideas and left with long-lasting friendships

- Trainers in emerging microfinance best practices who offered a new way to view finance (Read more about CAMFA, a project that supported KMF, then KLF, in 2004, and how its efforts for transforming the region’s financial sector panned out. )

- Technical advisors who introduced an organizational structure and culture that was market oriented, transparent, and bottom-up to staff members schooled in a failed, top-down, directed economy (Read more about a volunteer assignment at a Kyrgyz orchard.)

- Struggling traders, farmers, and entrepreneurs who were able to grow their livelihoods into thriving businesses

- Local managers and staff whose commitment, ingenuity, vision, and leadership grew the fund exponentially, influenced financial policy, attracted private investment, inspired competition by the banks, and contributed to today’s Kazakhstan, which offers dramatically more opportunity to significantly more people than it did 25 years ago

Shalkar described the relationships he forged with American colleagues as providential, enduring gifts that offered the KMF team and their customers new ideas and expanded opportunities. USAID’s investment made a profound difference in their economy and in their lives, demonstrating both America’s effectiveness and generous spirit.

As the U.S. pursues a foreign policy to bolster American strength, safety, and prosperity, may we incorporate the lessons that this artifact imparted—foreign assistance is most valuable when

- it spurs collaborative wins that foster hope, trust, and opportunity; and

- its impact, measured over time, garners respect and gratitude.

As a soon-to-be retired taxpayer, I truly hope that we find a way to commit to the vision, the collaborative spirit, and the time required to achieve meaningful returns on future investments in foreign assistance.

Comments