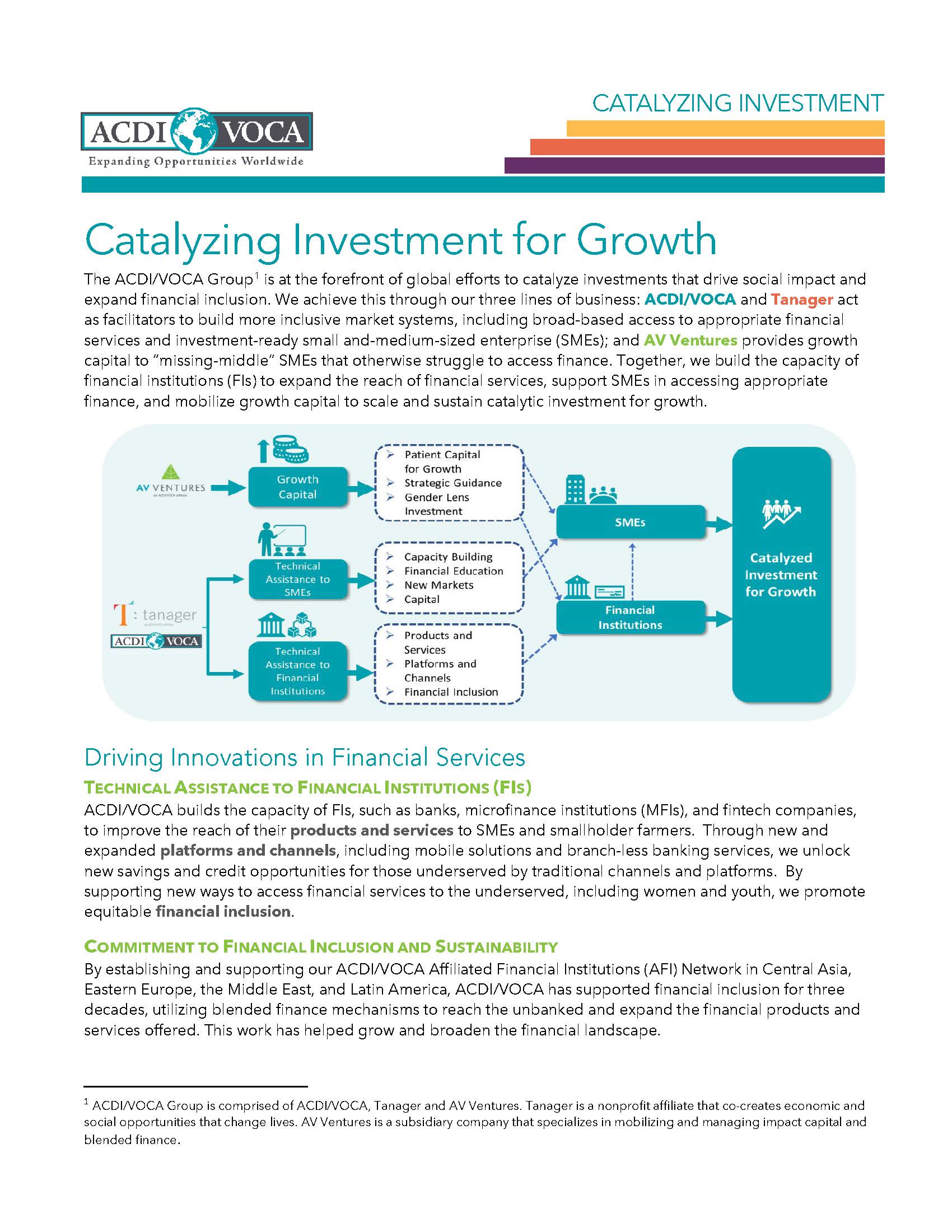

Read the Catalyzing Investment for Growth Info Sheet here.

A Case Study Of The Central North Region Of Burkina Faso Access the case study “Championing Transformative Changes in Gender …

Read the UN Global Compact Communication on Engagement 2022-2023 published July 31, 2024.

Sparking Enterprise Competitiveness and Innovation in the Lao People’s Democratic Republic Access the USAID Laos Microenterprise Achievements book in English …